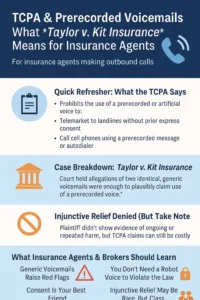

📞 TCPA & Prerecorded Voicemails: What Taylor v. Kit Insurance Means for Insurance Agents Making Outbound Calls

For insurance agencies and brokers, outbound calling is a vital part of lead generation, policyholder engagement, and retention strategies. But with consumer protection laws like the Telephone Consumer Protection Act (TCPA) in play, one misstep in your calling practices—especially with prerecorded voicemails—can open the door to serious legal trouble.

A recent case, Taylor v. Kit Insurance (June 10, 2025), highlights how courts are interpreting TCPA rules, and what insurance professionals need to know to stay compliant.

🔍 Quick Refresher: What the TCPA Says

The TCPA prohibits the use of a prerecorded or artificial voice to:

-

Make telemarketing calls to residential landlines without prior express consent.

-

Make calls to mobile phones using a prerecorded message or autodialer, unless an exception applies (e.g., prior express written consent).

For insurance brokers and agencies, that means even voicemail drops that sound “professional” or “automated” can potentially violate the law if not handled properly.

📂 Case Breakdown: Taylor v. Kit Insurance

In this case, the plaintiff alleged she received two identical voicemails from Kit Insurance—identical in voice, tone, content, style, and even file size. The voicemails were also generic (no name or personalized info), and others had reportedly received the same messages.

Kit Insurance argued the claims were vague and lacked evidence—no audio files, no transcripts—but the court disagreed. It ruled that the plaintiff’s consistent and specific descriptions were enough to plausibly allege use of a prerecorded voice, and therefore, a potential TCPA violation.

“Plaintiff has plausibly alleged that Defendant used a prerecorded voice.” — Taylor v. Kit Insurance, 2025

This is especially important for the insurance sector, where voicemail campaigns and automated outreach tools are commonly used in marketing.

🛑 Injunctive Relief Denied (But Take Note)

The plaintiff also asked for injunctive relief—a court order to stop Kit from making such calls in the future. But the court denied this request, citing a lack of evidence that the plaintiff (or proposed class members) faced ongoing or repeated harm.

Still, the takeaway here isn’t to ignore the risk—just because injunctive relief wasn’t granted doesn’t mean TCPA claims won’t move forward or result in costly settlements.

💡 What Insurance Agents & Brokers Should Learn

-

Generic Voicemails Raise Red Flags

Voicemails that sound the same for every prospect, especially without names or policy-specific info, may be seen as prerecorded under the TCPA. -

You Don’t Need a Robot Voice to Violate the Law

Even natural-sounding, professional voicemails can count as “prerecorded” if they’re identical and reused broadly. -

Consent Is Your Best Friend

Prior express written consent is the gold standard—especially when calling wireless numbers. Make sure your CRM or dialer logs it clearly. -

Injunctive Relief May Be Rare, But Class Actions Are Not

While the Taylor case didn’t move forward on injunctive relief, it sets a clear precedent for how easily a TCPA claim can survive early dismissal.

✅ Final Thoughts for the Insurance Industry

With outbound marketing and automated messaging tools playing a bigger role in insurance sales, compliance with TCPA is non-negotiable. Misclassifying or mishandling your voicemail strategy—even with good intentions—can lead to lawsuits, penalties, and damage to your brand reputation.

📌 Need help aligning your outreach strategy with TCPA guidelines? TLDCRM helps insurance agencies streamline operations, manage leads responsibly, and stay fully compliant.

🌐 Visit tldcrm.com for resources, or follow us on social media for real-time updates.